Comparing Single-Tenant DSTs to Multi-Tenant Investments

Which is Right for Your Clients?

Choosing the right real estate investment structure is a critical responsibility for investment advisors. When evaluating Delaware Statutory Trusts (DSTs), advisors typically weigh two primary options: single-tenant and multi-tenant properties. Each structure offers distinct benefits and trade-offs that can materially affect income stability, risk exposure, and long-term outcomes for clients.

Understanding how these DST structures differ—and how each aligns with a client’s objectives, risk tolerance, and portfolio strategy—is essential to making informed recommendations. This article examines both approaches to help advisors determine which structure may be most appropriate for their clients.

Why Investment Structure Matters in Real Estate DSTs

The structure of a real estate investment directly influences its risk profile, income predictability, and operational complexity. For DST investors, the distinction between single-tenant and multi-tenant properties often centers on concentration risk versus diversification.

Single-tenant DSTs typically emphasize predictability and simplicity, while multi-tenant DSTs prioritize income diversification and flexibility. Evaluating these trade-offs in the context of a client’s financial goals allows advisors to make more tailored, outcome-driven decisions.

Single-Tenant DSTs: Predictable Income with Concentrated Risk

Single-tenant DSTs involve properties leased to one occupant—often a creditworthy national tenant such as a healthcare provider, industrial operator, or well-known retailer. Examples may include companies like Pfizer, Sysco, McDonald’s, or Starbucks.

These investments are generally straightforward in structure and are often selected by clients seeking income stability and operational simplicity.

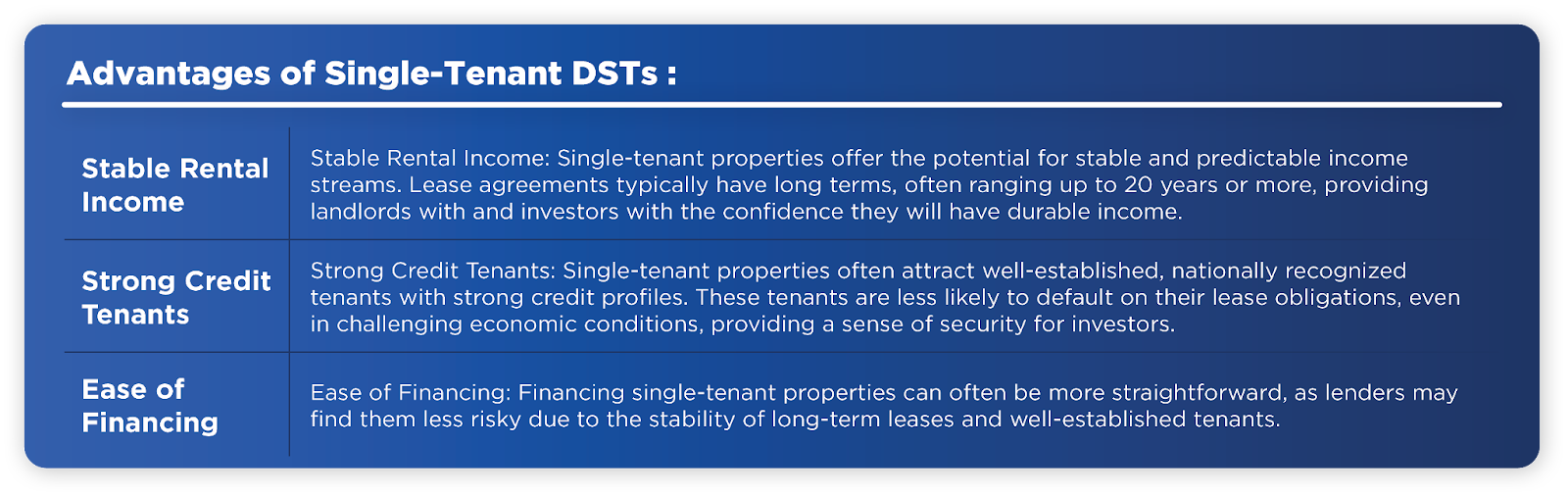

Key Advantages of Single-Tenant DSTs:

Stable Rental Income

Single-tenant leases are typically long-term, often extending 15–20 years or more. These extended lease terms can support predictable income streams over the life of the investment.

Strong Credit Tenants

Single-tenant properties are frequently leased to nationally recognized tenants with established credit profiles. These tenants may be better positioned to meet lease obligations during economic downturns.

Simplified Financing and Management

From a financing perspective, lenders often view single-tenant properties as lower risk due to long-term leases and tenant stability. Operationally, having one tenant reduces management complexity.

Potential Drawbacks of Single-Tenant DSTs

Potential Drawbacks of Single-Tenant DSTs

Tenant Vacancy Risk

The primary risk is concentration. If the sole tenant vacates or defaults, rental income may stop entirely until a replacement tenant is secured.

Re-Leasing Challenges

Replacing a single tenant—particularly in large or specialized properties—can be time-consuming and may involve extended lease negotiations and downtime.

Key Point: Single-tenant DSTs prioritize income predictability but expose investors to higher concentration risk tied to one tenant.

Exploring Multi-Tenant DSTs: Diversified Income with Greater Complexity

Multi-tenant DSTs consist of properties leased to multiple occupants, commonly found in multifamily housing, office buildings, or retail centers. These investments offer income diversification but typically require more active oversight

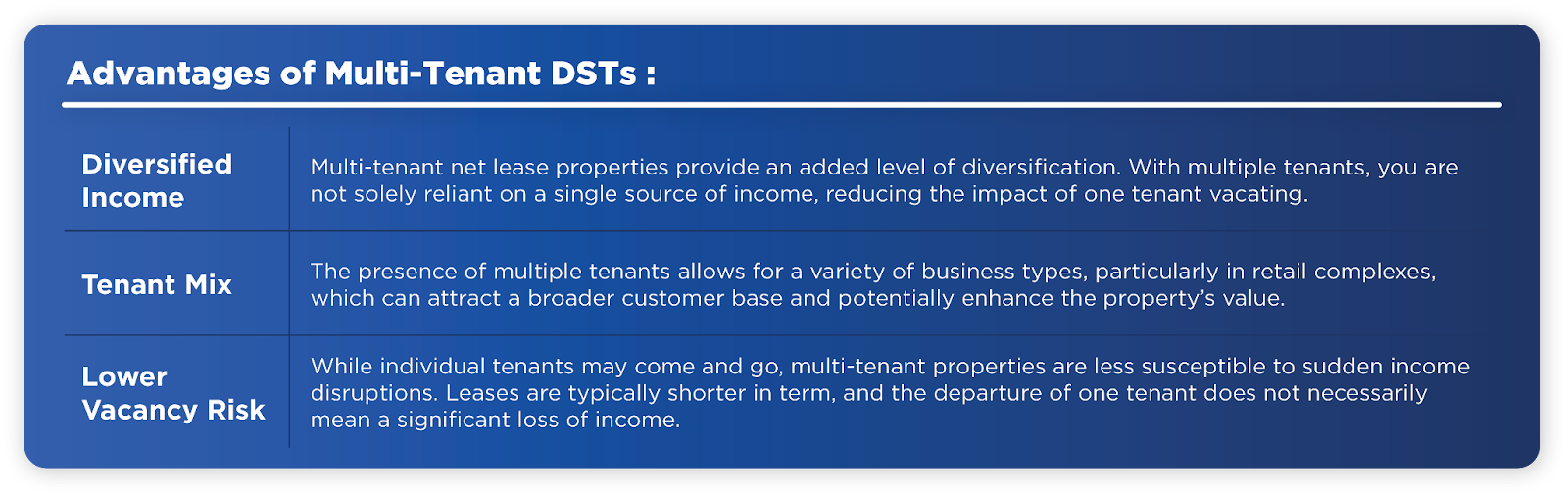

Key Advantages of Multi-Tenant DSTs

Diversified Income Streams

With multiple tenants contributing rent, income is less dependent on any single occupant. This diversification can help cushion the impact of individual tenant turnover.

Reduced Vacancy Impact

While tenants may come and go, the loss of one tenant generally does not eliminate all rental income, reducing the severity of vacancy-related disruptions.

Tenant Mix Flexibility

A diverse tenant base—particularly in retail or mixed-use properties—may enhance property appeal and adaptability over time

Potential Drawbacks of Multi-Tenant DSTs

Increased Management Complexity

Multi-tenant properties require ongoing coordination of leases, maintenance, tenant relations, and operating expenses, which can increase costs.

Variable Tenant Quality

Not all tenants will have the same financial strength. Weaker tenants may affect overall property performance, especially during economic stress.

Lease Coordination Challenges

Managing staggered lease expirations, rent escalations, and renewals adds administrative complexity.

Key Point: Multi-tenant DSTs offer diversification benefits but involve higher operational demands and variability.

Advisor Considerations: Aligning Investments With Client Goals

When guiding clients, consider these core factors:

- Risk tolerance: Single-tenant investments may be attractive for predictable income but expose clients to concentration risk. Multi-tenant investments distribute risk across tenants.

- Diversification strategies: Clients seeking diversified income might lean toward multi-tenant solutions, though single-tenant DSTs can also be diversified via multiple property holdings.

- Long-term objectives: Match the investment structure to clients’ financial timelines, income expectations, and broader portfolio strategy.

Key Point: Clients seeking stable, long-duration income may gravitate toward single-tenant leases, while those accepting variability for diversification may prefer multi-tenant assets.

Helping Your Clients Make the Right Real Estate Investment Decision

At CAI Investments, we specialize in single-tenant DSTs and can provide tailored solutions that align with your client's goals. If you’re considering these options for your clients, our team can help you further explore the process and select the most suitable DST investments for their portfolios.

Key Takeaways

- Single-tenant DSTs emphasize predictability and simplicity but involve tenant concentration risk

- Multi-tenant DSTs provide income diversification with increased operational complexity

- Client risk tolerance and income objectives should drive structure selection

- Diversification can be achieved through structure choice or portfolio construction

Frequently Asked Questions (FAQs)

What is a single-tenant DST?

A real estate investment holding a property leased to one tenant, often with a long-term lease and a predictable income stream.

How does a multi-tenant DST differ?

Multi-tenant DSTs derive rental income from several tenants, offering diversification and reduced dependence on any single lease.

What risk factors should advisors consider?

Advisors should weigh tenant concentration risk, vacancy exposure, income diversification, and lease management complexity.

Are multi-tenant investments more complex?

Yes — coordinating multiple leases and tenant relationships generally involves more operational oversight than single-tenant structures.

Can a client’s goals influence the choice between the two?

Absolutely — clients prioritizing predictable income may favor single-tenant DSTs, while those seeking diversified cash flow might lean toward multi-tenant DSTs.

About Author

CAI Investments

Subscribe to

our Newsletter

We are ready to help you until and unless you find the right ladder to success.

-png.png?width=950&height=306&name=42441%20CAI%20BOFU%20Email%20Schedule%20a%20consultation%20campaign%20CTA%201%20(3)-png.png)

Comments